Quick access to funding for payroll and growth

Receivables Funding

Cashflow is key for all businesses to survive and thrive. Whether it’s meeting payroll at the end of the week, or utilizing your cash to grow. Accessing this funding is often as simply as utilizing Invoice / Receivables Factoring. A quick solution to access funds while avoiding dangerous debt.

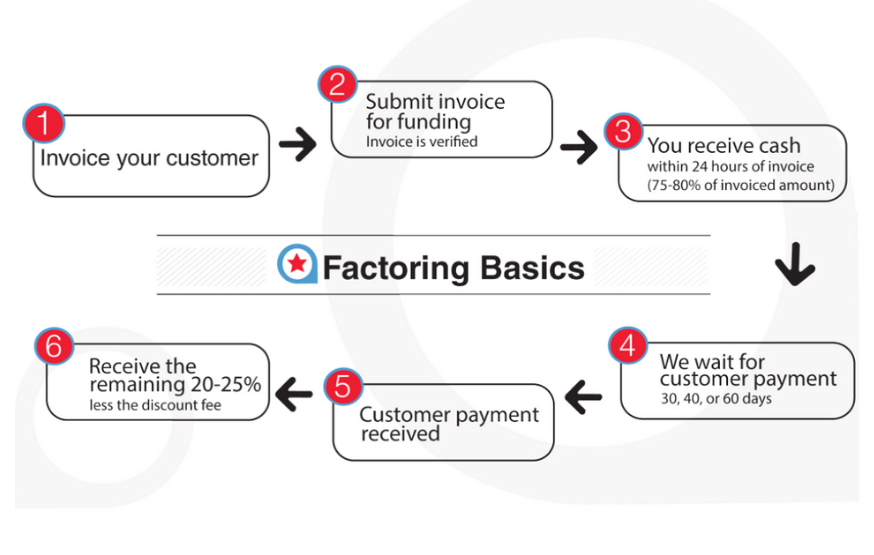

Factoring is a form of finance in which businesses use unpaid invoices as collateral for cash advances. Factoring instantly accelerates cash flow and provides immediate access to working capital.

Factoring is done invoice by invoice, so no actual debt or loan is created. Starting is easy – the first step is invoicing your customer. From there, submit your invoice to us for funding and you will receive the capital vou need to improve cash flow without going into debt.

let us find the right funding partner for you, too.

Tell us a little more about your company…

Simple Process

You complete a brief application and submit the minimal paperwork required.

- Due diligence completed (review of receivables, customers & invoice history).

- Proposal prepared for your review.

- Final agreements signed.

- Invoices submitted.

- Cash received!

The complete process generally takes approximately 5 days.